what is considered income for child support in colorado

The guidelines use a formula based on what the parents would have spent on the child had they not separated. Each parents gross income is placed into the formula.

Mortgage Ready Checklist Buying A Home Texaslending Com Home Buying Buying First Home Home Buying Process

If the employees past due child support is more than 12 weeks old withhold 60 of the disposable income.

. Gross income before taxes of both parents. It is therefore vital that parents understand what funds can be considered income under the child support guidelines and what funds are excluded from the definition of income. 3 annual overnights with each parent.

Subsection 5 sets forth a long list of what counts as income. Child support payments in Colorado are calculated using the income shares method. Child support is a percentage roughly 20 for 1 child and an additional 10 for each additional child of the combined gross income of the parents which is then split between both.

Child support could also pay for extraordinary expenses specific to the child. The legislature recognizes that the. I will dispense with reciting the whole list but will set forth some of the more commonly misconstrued items beyond what someone might earn from his or her paid job.

The Colorado Child Support Guidelines are designed to make sure that a fair share of each parents income and resources are given to their child. Income Part 1 In Colorado numerous factors go into calculating child support. Much of the confusion of the definition of income in many states comes from the fact that state child support statues do not define exact.

What Is Considered Income. Adjusted gross income the child support obligation must be capped at twenty percent of the obligors adjusted gross income. The minimum guideline amount for obligors earning less than 1500 per month shall not apply.

Be sure that you understand your rights and options when it comes to all aspects of your divorce. Ad Instant Download and Complete your Child Support Forms Start Now. Conversely cases in New Mexico.

Depending on the circumstances it is possible for social security benefits retirement benefits loan proceeds and stock option sales proceeds to also be considered income in terms of child support. 2 number of children. Colorado does use the income share method to calculate child support.

The basic categories for which child support pays are food clothing and housing. Select Popular Legal Forms Packages of Any Category. 1 - Basic Expenses.

14-10-114 it was unclear how a court should determine income for cases where long-term ie. The new law greatly simplified the schedule of basic child support obligations by creating a new 10 minimum across the board when the person paying child support earns less than 650. 14-10-115 Colorado Child Support Guidelines has been updated three times in the last five years.

The Basics You Should Know About Child Support Calculations in Colorado. Payments depend on the combined incomes of the parents as well as the number of children. For the purposes of this post I am going to talk about the general factors you need to understand how the Colorado Child Support guidelines work.

Income can refer to more than just the wages. It is important to understand exactly what the law considers income when determining a child support award. For more information on how child support is calculated see Child Support in Colorado.

The amount paid or received by an individual parent also depends on income and. Colorado calculates child support using the Income Shares Model of support which is based on the gross income of both parents and general information about what intact families spend on their children. Calculation of the gross income of each parent gross income being income from any source other than child support payments public assistance a second job or a retirement plan.

Under Colorado Revised Statutes Section 14-10-115 a parents adjusted gross income refers to his or her gross income minus pre-existing child support and alimony obligations. How Child Support is Calculated in Colorado. As detailed below determining income for a party in a Colorado divorce can be complicated.

A larger combined income or more children usually means greater payments. To start income for child support purposes is generally set forth in CRS. 4 work and education related child care costs.

How Child Support Amount is Determined. The noncustodial parents share of support sets the amount of the order. Just because the.

1 monthly income of both parties. The Guidelines state that such a couple should have a support obligation of 1215 a month. Cases in Alaska Colorado Montana and Ohio have held that the interest on an IRA is income for purposes of child support.

Basic Child Support Expenses. The following may be factored into the formula. There is a new 10 minimum child support order when the obligors income is under 650.

Child support is calculated using three major factors. As a non-custodial parent the one who cares for the child less than 50 of the time you will be required to pay child support to the other party the custodial parent. The custodial parent should use the money to pay for ordinary expenses related to childcare such as food shelter clothing education travel and medical care.

If the employees past due child support is less than 12 weeks old please withhold 50. Permanent maintenance was requested or the parties annually made 75000 in total. Before the recent amendments to Colorados law on maintenance CRS.

Other customary expenses which the parents expressly include. Your choice is how many of your childs expenses you believe are included in this amount. What is not included is said to be an extraordinary expense.

Colorados Schedule of Basic Child Support Obligations sets this amount. The main factors include. Changes to Child Support for Those with Incomes Under 650.

If you are a salaried or full-time hourly employee this is relatively simple. All Major Categories Covered. If your employee does not earn enough to meet their support obligation you must withhold a percentage of their disposable income.

That means dad will owe 50 of 1215 as he makes 50 of the total or 60750. Lets say that mom has primary custody the formula is different if the parents share joint parenting and both parents make 5000month each. The non-custodial parents income is 666 of the parents total combined income.

The starting point for determining the child support payments in Colorado is the pre-tax income of each parent. This includes a 2018 change to how the courts define adjusted gross income and alimony or maintenance received. 5 the childrens share of health.

Therefore the non-custodial parent pays 666 per month in child support or 666 of the total child support obligation.

Dos And Don Ts Of Public Speaking Public Speaking Continuing Education Continuing Education Credits

Learn How To Use Separable Inseparable Phrasal Verbs Child Support Payments Child Support Quotes Child Support

Child Support Modification Termination Colorado Family Law Guide

Child Support Basic Obligation Colorado Family Law Guide

Free Rental Application Form Real Estate Forms Rental Application Real Estate Forms Colorado Rental

Emancipation For Colorado Child Support Colorado Family Law Guide

Evergreen Colorado Local Market Report May 16 2021 How S The Market Rate Of Sales V Inventory Evergreen Colorado Evergreen Colorado Real Estate

Colorado Legal Research Colorado Legal Corporate Counsel

Organizing Services Professional Organizer Organizing Your Home

Get My Art Printed On Awesome Products Support Me At Redbubble Rbandme Https Www Redbubble Com I Sticker Creede Colorad State Flags Creede Creede Colorado

Voices For Utah Children A Comparative Look At Utah And Colorado Economic Opportunity School Readiness Utah Kids Education

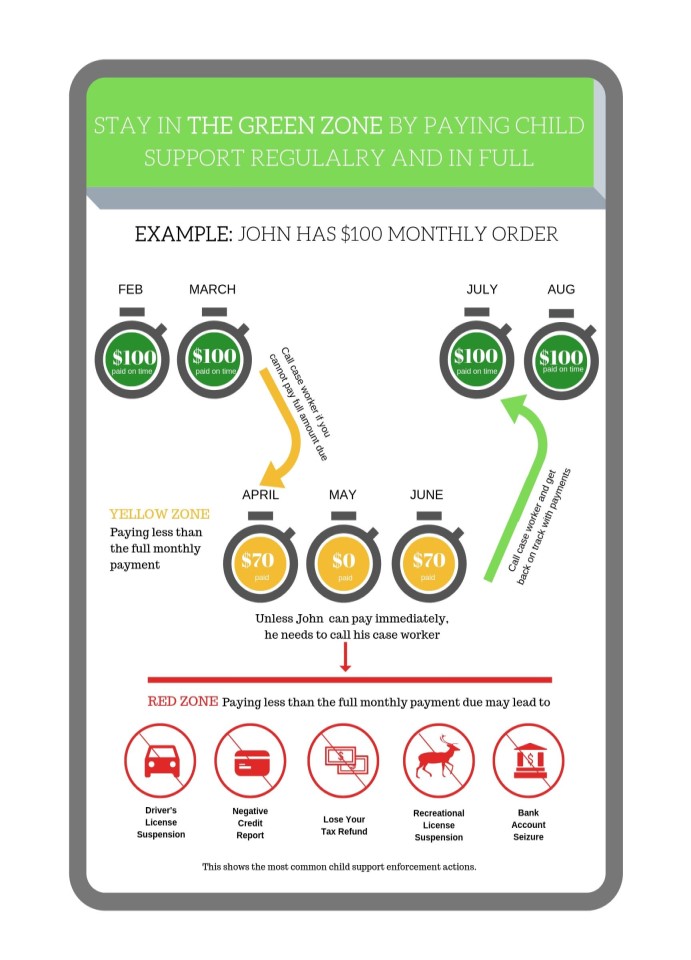

Enforcing Orders Colorado Child Support Services

Salaries In Over Half Of The U S Won T Pay The Bills Being A Landlord Salary Cost Of Living

Frequently Asked Questions Colorado Child Support Services

New Vernon Washington Township Harding Long Valley Morris County New Jersey Divorce Child Support Mediator Child Support Laws Supportive Divorce And Kids

Do I Need An Out Of State Attorney Dads Divorce Child Custody Spring Break Topeka

What Bankruptcy Can Do For You Mortgage Payment Mortgage Payment Calculator Budgeting Money